How to Move to Canada from the US: A Simple Guide

Authors: Tiffany Woodfield, TEP®, Associate Portfolio Manager, CRPC®, CIM® and John Woodfield, Portfolio Manager, CFP®, CIM®

Moving to Canada from the US can be an exciting opportunity. But it comes with its complexity.

It requires careful planning, particularly if you have substantial assets.

Whether you're moving for work, retirement, or family reasons, it’s important to understand the main steps and prepare in advance. Below is a simple guide to help you navigate the key steps involved in making this transition smoother.

If you're serious about moving to Canada and have a robust investment portfolio, speak with a cross-border financial advisor before moving. They can advise you on the critical financial steps to avoid excess tax and prevent costly mistakes.

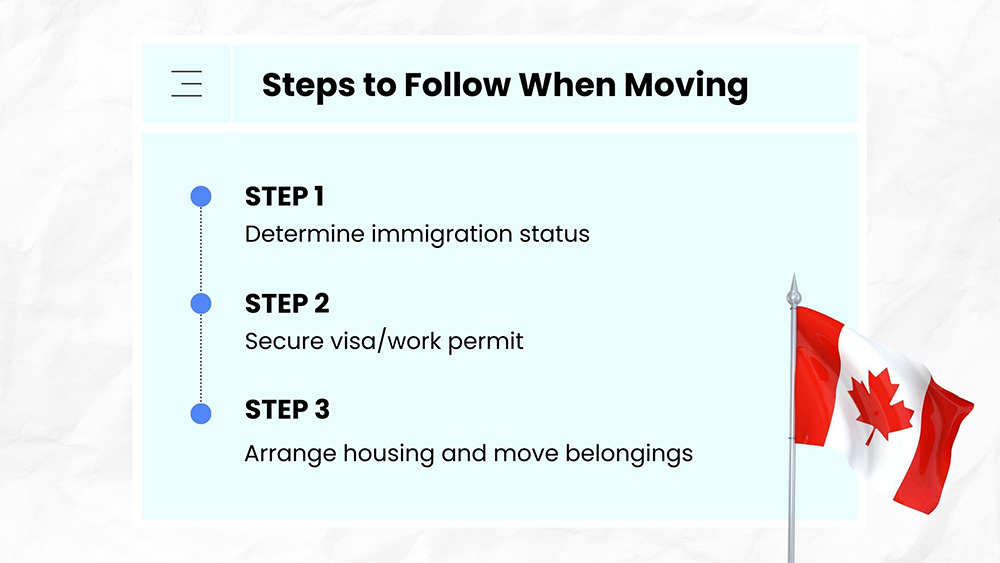

Now, let's cover 12 steps to take when moving to Canada from the US.

1. Determine Your Immigration Status

Many people moving from the US to Canada aim to obtain Canadian permanent residence, which provides a path to living, working, and accessing healthcare long-term.

The first step in moving to Canada is determining which immigration pathway you qualify for.

The most common routes are:

- Permanent Residency through programs like Express Entry, the Provincial Nominee Program (PNP), or family sponsorship.

- Work Permits if you have a job offer from a Canadian employer.

- Study Permits if you plan to attend school in Canada.

A foreign national (any individual who is not a Canadian citizen or permanent resident) may enter Canada on various visas, such as visitor, student, or work visas, or apply for permanent residency through immigration programs like Express Entry or the Start-Up Visa Program.

Speak with an immigration lawyer to determine the best pathway for you.

Resources:

- Express Entry Program

- Start-Up Visa Program

- Provincial Nominee Program

- Work Permits

- Study Permits Canada

- Family Sponsorship

2. Check Eligibility for Permanent Residency (PR)

Obtaining permanent residency (PR) is crucial if you want to live in Canada long-term.

You must meet criteria such as age, education, work experience, and language proficiency. Express Entry is the most popular pathway, and you can calculate your Comprehensive Ranking System (CRS) score to see if you're eligible.

One common way Americans become permanent residents is through the Federal Skilled Worker Program, which allows professionals to immigrate to Canada based on their education, work experience, and language skills. Check the Canadian government website to see if you can apply, or seek the assistance of an immigration attorney who can guide you through the process.

In addition, make sure you're aware of the tax implications of becoming a permanent resident of Canada. Once you become a permanent resident of Canada, you'll need to ensure you comply with both US and Canadian tax laws.

3. Apply for a Visa or Work Permit

Once you determine your eligibility, you can apply for a visa or work permit. If you have a job lined up, your employer may help facilitate the process, but you'll need to submit documents proving your employment offer, qualifications, and reasons for moving.

4. Prepare Financial Documentation

Canada has minimum financial requirements to ensure newcomers can support themselves. You may need proof of funds, which typically includes bank statements, investment accounts, or other financial assets.

5. Ensure You Have Health Insurance Coverage

Canada has a public healthcare system, but newcomers are typically not eligible for provincial health coverage right away. You should purchase private health insurance to cover you during the waiting period. Health insurance is particularly important if you're moving with family members.

6. Secure a Job in Canada (If Applicable)

While not mandatory for everyone, having a job lined up before moving to Canada can make the immigration process easier. Securing a job offer is essential if you're moving under a work permit. For Express Entry or other PR programs, Canadian work experience can boost your eligibility.

7. Understand Tax Implications

Moving to Canada means understanding the tax implications for both countries. Although the US and Canada have a tax treaty, you must still file taxes in both countries if you’re an American citizen. Working with a cross-border financial advisor and accountant is essential to avoid double taxation and ensure you're meeting all your tax filing obligations.

8. Transfer Assets and Investments

If you have significant assets and investments in the US, transferring them to Canada may seem complex. However, moving your investment accounts is relatively stress-free when you work with a qualified team of cross-border specialists. Be sure to review your investment accounts, retirement savings, and real estate holdings. Then, speak with a cross-border financial advisor who can guide you on effectively managing these assets.

9. Find a Place to Live

Before arriving in Canada, research housing options. Make sure to consider location, budget, and proximity to schools or work. If you're still deciding whether to buy right away, renting a home might be a good first step. Check prices in advance to get a sense of the market. Canada has a booming real estate market, and you may be surprised by the prices. So it's good to get that sticker shock out of the way well before you make the move to Canada.

10. Move Your Belongings

When moving from the US to Canada, you'll need to prepare a list of what you plan on bringing across the border. The Canadian government allows you to bring personal items duty-free, but there are rules about declaring high-value items, vehicles, and other large assets.

11. Set Up Canadian Bank Accounts

Once you're in Canada, opening a local bank account is essential for day-to-day transactions. Some Canadian banks offer newcomer programs that make opening accounts and transferring funds from the US easier.

12. Enjoy Your Next Adventure!

If you have a solid plan and execute it with the help of a cross-border team, you can enjoy your new life and start planning your next adventure. Moving across the border can feel stressful, but with the right guidance, you can relax knowing everything is covered.

Financial Planning Tips for Americans Moving to Canada

Common Questions About Moving to Canada from the US

- How long does it take to get permanent residency in Canada?

It depends on the immigration program you apply for. Express Entry can take as little as six months, while other programs like family sponsorship may take longer. - Can I keep my US citizenship after moving to Canada?

Yes, both the US and Canada allow dual citizenship. You can retain your US citizenship while becoming a permanent resident or citizen of Canada. - Do I need a job offer to move to Canada?

Not necessarily. Some programs like Express Entry do not require a job offer, but having one can improve your chances of getting permanent residency. - Will I have to pay taxes in both the US and Canada?

You may need to file taxes in both countries, but the US-Canada tax treaty can help avoid double taxation. It's important to consult a cross-border tax expert. - How much money do I need to move to Canada?

For Express Entry, the required funds depend on the size of your family. For example, as of this writing, a single applicant needs CAD 14,690 in savings, while a family of four needs about CAD 27,297. These numbers change so make sure you check the government site for the most up-to-date information. - How do I transfer my retirement accounts from the US to Canada?

Moving retirement accounts can be complex due to tax implications. Speak with a cross-border financial advisor to ensure a smooth transfer without triggering tax or penalties. - How long can I stay in Canada as a visitor while waiting for PR?

You can visit Canada for up to six months without a visa, But if you're waiting for permanent residency, it's better to apply for a temporary visa or permit. - Can I bring my car to Canada?

Yes, but your vehicle must meet Canadian safety and emission standards. You’ll need to declare it at the border and may need to make modifications. - Do I need health insurance in Canada?

You should get private health insurance initially, as provincial healthcare may have a waiting period before you become eligible. - How can I bring my pets to Canada?

You can bring your pets, but they'll have to meet Canadian pet import requirements, including vaccinations and health certificates. - What is the cost of living in Canada compared to the US?

The cost of living varies by region. Major cities like Toronto and Vancouver can be more expensive than some US cities, while smaller Canadian towns may offer a lower cost of living. - Can I rent a home in Canada before becoming a permanent resident?

Yes, you can rent a home as a temporary resident, and many newcomers choose to rent before purchasing a property. - How difficult is obtaining Canadian citizenship?

To become a Canadian citizen, you must hold permanent resident status and meet several key requirements. Typically, you must have lived in Canada for at least three out of the last five years (1,095 days) as a permanent resident, file your taxes during that time, and pass a citizenship test covering Canadian history, values, and government.

Citizenship Canada oversees the application process. Once you're approved, you'll join the ranks of Canadian citizens, enjoying full rights such as voting and holding a Canadian passport.

- What is the Federal Skilled Worker Program?

The Federal Skilled Worker Program (FSWP) is an immigration pathway for skilled professionals who want to become permanent residents of Canada. It targets individuals with education, work experience, and language proficiency in English or French, allowing them to contribute to Canada's economy.

This program is part of the Express Entry system, which helps fast-track immigration applications. Along with the FSWP, the Federal Skilled Trades Program (FSTP) is another key component of Express Entry. The FSTP focuses on skilled workers in trades like construction, plumbing, and electrical work.

- What is the Start-Up Visa Program?

The Start-Up Visa Program is designed for entrepreneurs who want to establish a business in Canada. It provides permanent residency to foreign entrepreneurs with innovative business ideas that can create jobs for Canadians. To qualify, applicants must have a letter of support from a designated organization (venture capital firm, angel investor group, or business incubator) and meet language and financial requirements.

Next Steps

If you’re a Canadian resident or are planning on moving to Canada or the US and need assistance with moving and optimizing your investments, estate planning, wealth management and portfolio management, please get in touch. At SWAN Wealth, we specialize in Canadian financial planning, cross-border financial planning and cross-border wealth management.

Read More

A Guide for Americans Retiring to Canada

The Cost of Renouncing Your US Citizenship

The Basics of Renouncing Your US Citizenship

About the Authors

Tiffany Woodfield is an Associate Portfolio Manager licensed in Canada and the USA, a Chartered Investment Manager (CIM), a Chartered Retirement Planning Counselor (CRPC), a Trust and Estate Practitioner (TEP) and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany advises clients who live in Canada and the United States and want to simplify their cross-border financial plan, move their assets across the border, and optimize their investments to minimize their tax burden. Together Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe whether they live in Canada or the U.S.

John Woodfield is a Financial Management Advisor (FMA), a Chartered Investment Manager (CIM), and a Certified Financial Planner (CFP), and in 2007 was inducted as a fellow of the Canadian Securities Institute (FCSI). As a portfolio manager and CFP®, he works with clients across Canada. John Woodfield’s clients are families, individuals and business owners who understand the importance of comprehensive wealth and investment plans driven by the lifestyle they want to lead.

Schedule a Call

Schedule a 15-minute introductory call with SWAN Wealth Management. Click here to schedule a call.