Canadian RRSP Facts for Dual-Citizens, Expats, and Canadians

Written by Tiffany Woodfield, CRPC®, CIM®, TEP®

Anyone planning on retiring in Canada must be aware of the benefits and pitfalls of an RRSP and whether it’s an investment tool they should be using.

In this article, we’ll review the basic RRSP rules every person retiring in Canada needs to know along with some investment tools you may find more beneficial to your financial situation.

Summary of Key Points:

- An RRSP is a great retirement savings vehicle for dual citizens, expats and Canadians.

- One should not transfer an IRA to an RRSP.

- It’s important to avoid investing in Canadian mutual funds and seek out a portfolio manager who can offer individual investments.

- It’s best not to invest in a TFSA as a dual citizen or expat as it causes additional complicated tax reporting and increased costs.

- You aren’t limited by PFIC rules when investing in an RRSP as it is recognized by the Canada/US Tax Treaty.

- 401(k)s and RRSPs have similarities and differences that are important to understand.

Table of Contents:

- RRSP Complexities

- RRSPs Are Not Double Taxed

- Form 8891 Is Out

- RRSPs, RRIFs, Group RRSPs, and TFSAs - What’s the Difference>

- How Does an RRSP Work?

- Tax Advantages of an RRSP

- RRSP Contribution Limits

- Withdrawing from an RRSP

- What Investments Can You Hold in a RRSP?

- RRSP vs. TFSAs

- Group RRSPs

- Should You Convert an RRSP to a RRIF?

- Closing RRSP Account at Age 71

- RRSPs vs 401(k)s

- Transferring a 401(k) to an RRSP

- Should You Hold Mutual Funds or Stocks in an RRSP?

- Benefits of Working with a Portfolio Manager

- Working with a Cross-Border Advisor

A registered retirement savings plan (RRSP) is a Canadian investment vehicle designed for holding savings and investments. It can be opened at a bank, brokerage firm or through an employer if it is a Group RRSPs (Group Registered Retirement Savings Plan). An investor gets a tax deduction for the funds placed in an RRSP and isn’t taxed until they are withdrawn. As a result, the money put in reduces their taxable income for that year.

RRSP Complexities

The annual limit is based on earned income from the prior year or any unused room from previous years. Dual citizens and expats are able to open an RRSP as long as they have accumulated room. But at age 71, the RRSP must be converted into a RRIF account, and you must start taking out distributions once reaching the age of 72.

Although a Canadian RRSP is similar to an IRA, there are complications if transferring an IRA into a RRSP. There are withholding taxes in the U.S and, as a result, you would need to top up the RRSP with funds from other sources. If the investor doesn’t have the funds to top up the RRSP, they may lose this room forever and have to pay tax in Canada on the difference between the IRA value and amount contributed to the RRSP.

Example:

If an investor had an IRA worth $1,000,000 and wanted to transfer it to a RRSP, 30% (or $300,000) would be withheld in the United States. but would only be contributing $700,000. If the investor did not have the $300,000 from other sources to top up the RRSP, they would be taxed in Canada on the difference between the IRA value and the amount contributed to the RRSP. The RRSP room would also be lost forever if the extra funds weren’t added in the year rolled over from the IRA.

In addition, the tax liability can be stretched out longer with an IRA as an investor can defer tax with multiple beneficiaries. Whereas, with an RRSP, the tax can only be deferred when the spouse is the beneficiary.

One more consideration is that an RRSP cannot be moved back to an IRA.

RRSPs Are Not Double Taxed

An RRSP is recognized as part of the Canada/US Tax-Treaty so an investor will not be double taxed or have additional tax filings. If an investor is working in Canada, contributing to an RRSP is a great option as it reduces the tax bill in Canada in the year it was earned. One would be deferring the tax and only pay tax when the money is taken out of the RRSP. Ideally, when the money is withdrawn, the investor will be in a lower marginal tax bracket. Another big advantage is the investments held within the RRSP can grow tax free until withdrawn.

Form 8891 Is Out

It used to be necessary to file form 8891 with the IRS annually to benefit from deferring the income earned within the RRSP plan. This was time-consuming, expensive and often the form was filled out incorrectly. Luckily, the IRS eliminated the need to file this form and, as a result, many U.S. persons with RRSPs or RRIFs will now automatically qualify for tax deferral similar to if they held an IRA. This does not take away the need to report FBARs on FinCEN form and these can still trigger large penalties if they are not filed.

For more information view this page: Report of Foreign Bank and Financial Accounts (FBAR)

RRSPs, RRIFs, Group RRSP, and TFSAs - What is the difference?

In addition to understanding RRSPs, an investor should also be aware of the benefits and uses of RRIFs, Group RRSPs, and TFSAs.

Providing an investor has room, they can contribute to an RRSP up until December 31st of the year they turn 71. At that time, your RRSP becomes a RRIF or Registered Retirement Income Fund, and you can then no longer contribute and will have to take out a minimum withdrawal each year.

A Group RRSP is a Group Registered Retirement Savings Plan set up by an employer for their employees. The contributions are easy to make as it is deducted directly from your paycheck and the employers can match up to 5% of the salary.

A TFSA is a common account used in Canada which offers tax-free growth on the investments in the account. There is an annual contribution limit, but it isn’t based on earned income. Unfortunately, the IRS doesn’t treat a TFSA the same way as Canada, and it is seen as a Passive Foreign Investment Company (PFIC). This causes additional complicated tax filing and increased costs.

How Does an RRSP Work?

An RRSP allows an investor to defer income tax during their high income earning years so that when they retire they can withdraw the proceeds at a lower tax rate. A Registered Retirement Savings Plan can be opened at a bank or financial institution. The federal government sets an annual amount one can contribute each year that is based on earned income.

Tax Advantages of a RRSP

The tax advantages of an RRSP are that the contributions are tax deductible meaning they decrease the tax liability in the current year, and an investor doesn’t pay tax on the investment growth as long as the money remains in the plan. The money will be taxed at your marginal tax rate when you eventually take it out.

Example:

Picture an RRSP as an empty box. Money that an individual places in that box is removed from their taxable income in the current year. If their salary is $150,000 per year and they place $20,000 in the RRSP “box”, they are then taxed as if they only made $130,000 ($150,000 less $20,000). It might even move them to a lower marginal tax rate. When they withdraw money from the box—normally when they are retired—they pay taxes at their marginal tax rate. So for example, if they withdraw when they have an income of $60,000 then remove $20,000 from the RRSP box they will be taxed as if they earned $80,000 ($60,000 plus the $20,000). This would still be a much lower marginal tax rate than when they had an income of $150,000.

What Are RRSP Contribution Limits?

The contribution limits are set so that an individual, their spouse or common-law partner can contribute up to 18% of their previous year’s income to a maximum of $31,560 for 2024. A person can carry forward room accumulated from previous years, which doesn’t count towards the yearly maximum.

To determine the limit on how much contribution room you have, go to the CRA website.

When Can You Withdraw from an RRSP?

An individual can withdraw from an RRSP at any time, but if they take money out before the age of 71, they will face withholding tax of between 5% and 30%. One could also lose the contribution room forever.

Two exceptions to this rule are:

- The RRSP Home Buyer’s Plan allows an individual to take out up to $25,000 penalty-free and they do not lose the room as long as they follow the repayment rules.

- The Lifelong Learning Plan is where someone can borrow up to $20,000 (a maximum of $10,000 per year) from their RRSP to fund their education. As long as they begin repaying the loan after 5 years from their first withdrawal and pay the full amount back by 10 years, they do not lose the room.

What Investments Can You Hold in a RRSP?

An individual can hold a variety of investments in their RRSP such as cash, GICs, ETFs, stocks, bonds, mutual funds, and REITs. As an American citizen or green card holder living in Canada, an investor isn’t limited by what investments they can put into an RRSP. What this means is they can hold Canadian ETFs and Canadian mutual funds and will not face the PFIC restrictions as long as they are held in the RRSP. A good strategy is to hold US investments in an RRSP that pays dividends because there isn't the same tax break as with Canadian dividends.

RRSPs versus TFSAs

A Tax Free Savings Account (TFSA) is a registered investment or savings account that allows tax-free gains for Canadian tax purposes. Unfortunately, the IRS doesn’t see the TFSA account the same way as Canada. The income earned in a TFSA is taxable for US persons and the IRS may consider TFSAs to be foreign trusts. A situation where it may be useful for a US citizen (or green card holder) living in Canada to have a TFSA is if the individual has Canadian taxes payable on other non-US investment income outside of the TFSA. The Canadian taxes payable on this investment income can be used to offset some of the US income from the TFSA.

An RRSP is recognized by the IRS and part of the Canada/US Tax treaty. Therefore, a US person does not have to report or pay tax on the growth each year. This makes it a better tool to use than the TFSA which isn’t part of the tax treaty.

What are Group Registered Retirement Savings Plans?

A Group Registered Retirement Savings Plan is set up by an employer. Group RRSPs are not all the same and they can vary from one company to the next with rules around who can enroll. The employee contributes directly from their paycheque and the employer will normally match up to a certain percentage. The funds are managed by large financial institutions with a set list of investments to choose from. The same rules on contribution limits and the same tax deferral advantage of an RRSP account apply to Group RRSPs.

The major benefit of a Group RRSPs is it is forced savings and the company matches the contributions, up to a certain percentage.

Should You Convert an RRSP to a RRIF or Buy an Annuity?

An individual must convert their RRSP to a RRIF or purchase an annuity by December 31st of the year they turn 71. They don’t actually have to start taking income in the year they turn 71 but must do so the following year.

A RRIF is the most common option because it offers so much flexibility. An individual can decide the income amount and frequency as well as decide the investments. They also have the ability to make changes along the way depending on their circumstances. There are minimums set by the federal government so aside from that, someone can tailor to their income needs. When they pass away, the remaining RRIF assets will be transferred to their beneficiary. If this is to a spouse, it will not trigger tax but if to another beneficiary, it will be transferred as income on the estate’s final tax return.

A Life Annuity is an insurance product that helps an individual convert their money into a pension. An investor would hand over their funds to the insurance company and the insurance company pays a set income that is guaranteed for the rest of the individual’s life. When they pass away the income will stop. There are a number of different types of annuities. The biggest reason someone chooses an annuity over a RRIF is the guarantee. The major disadvantage is funds are locked in and there isn’t any flexibility.

Fixed Term Annuity- The main difference between a life annuity and fixed annuity is the length of time an individual will be receiving the income. A life annuity is for their entire lifetime and a fixed annuity is for a set time frame such as 5, 10, or 20 years.

Closing Your RRSP Account at Age 71

If an individual were to close out their RRSP at age 71, they would have the full value of their RRSP added to their income and it would be taxed in one year. This usually isn’t the best option as a significant amount of a person’s money would go immediately to the government.

RRSPs and 401(k)s - Similarities and Differences

401(k)s and RRSPs are plans designed by the United States and Canadian governments to provide a tax deferred way for people to save and grow their retirement funds. Both an RRSP and 401(k) have annual contribution limits. The contribution limit for a RRSP is based on an individual’s earned income in the year prior, to a maximum, and can be carried forward indefinitely. A 401(k) is a set yearly amount regardless of income and it cannot be carried forward. The 401(k) offers a “catch up” provision where once an individual is over 50, they receive additional contribution room. There is a penalty of 10% for early withdrawal from a 401(k); whereas, an RRSP only has withholding taxes and no penalty. A 401(k) is set up through an employer while an RRSP can be set up through a bank or financial institution. A group retirement savings plan Group RRSPs is an RRSP set up through an employer in Canada.

Transferring a 401(k) to a RRSP

To transfer a 401(k) to Canada, an individual would need to roll it into an IRA and then transfer the IRA into an RRSP. This becomes complicated because of 30% withholding taxes from the IRS and having to top up the RRSP from other sources or one will be taxed in Canada as inclusion income. A better solution is to roll over the 401(k) into an IRA and have it managed with a dual licensed advisor from Canada. This avoids the complications of withholding taxes and provides flexibility if an individual decides to move back to the U.S. As well, the IRA can be a superior investment vehicle as it allows an individual to stretch out the tax liability longer because multiple beneficiaries benefit from keeping the tax deferral status of the IRA.

Should You Hold Mutual Funds or Single Stocks in an RRSP?

In an RRSP, an individual is allowed to hold both types of investments. So what is the difference?

A mutual fund is a packaged product of a pooled group of individual holdings with a common goal. To understand the difference, consider real estate as an example. A mutual fund is like buying into a strata. An individual’s results are connected to the other homeowners in the strata and based on what the group wants and needs.

When an investor purchases a mix of individual stocks, it is similar to owning their own home and it is tailored to their own needs. Very often someone can purchase the same stock positions individually that are held in a pooled mutual fund and at a lower cost. It isn’t to say there isn’t a place for mutual funds since they can be very useful in some areas of an individual’s investment mix. Mutual funds can be a great way to get diversification if someone doesn’t have a lot of money to buy individual positions or when you want exposure to a specific part of the market.

While an RRSP can hold diversified investments, there are benefits as a Canadian resident to holding US dividend paying stocks in the RRSP. This is because Canada taxes foreign income, such as US dividends that are held outside of the RRSP, like interest and they are fully taxable and there are withholding taxes. On the other hand, Canadian dividends are taxed favorably for Canadian residents and are therefore more tax efficient to be held outside of the RRSP.

The Benefits of Working with a Portfolio Manager or Independent Fiduciary Advisor

A portfolio manager has a fiduciary duty, meaning they legally must use their expertise and discretion in a client’s best interest. Essentially this means, as a fiduciary, an advisor cannot just recommend a product that would give themselves the best compensation. Rather they are legally required to recommend products that are most appropriate for the client.

As a financial advisor who isn’t a portfolio manager the requirement is to deal fairly, honestly and in good faith with clients. However, a portfolio manager has a fiduciary duty and must act in the absolute best interest of the client. Another major benefit of a portfolio manager is they can implement an investment strategy tailored to an individual’s needs.

When investing with a portfolio manager, an investor is cutting out the middleman between a client and a mutual fund packaged product. Purchasing mutual funds generally increases the costs to the investor and the fees for a mutual fund are not tax deductible. The costs of a portfolio manager are professional fees much like with a lawyer or accountant, and they are tax deductible for non-registered accounts.

Cross-border clients have a greater need to seek out a portfolio manager because, as a US person, they cannot invest in Canadian mutual funds or Canadian ETFs without facing additional consequences. These are considered PFICs by the IRS resulting in additional filing requirements and increased costs. A portfolio manager has the ability to invest in individual stocks which can keep reporting to the IRS simpler.

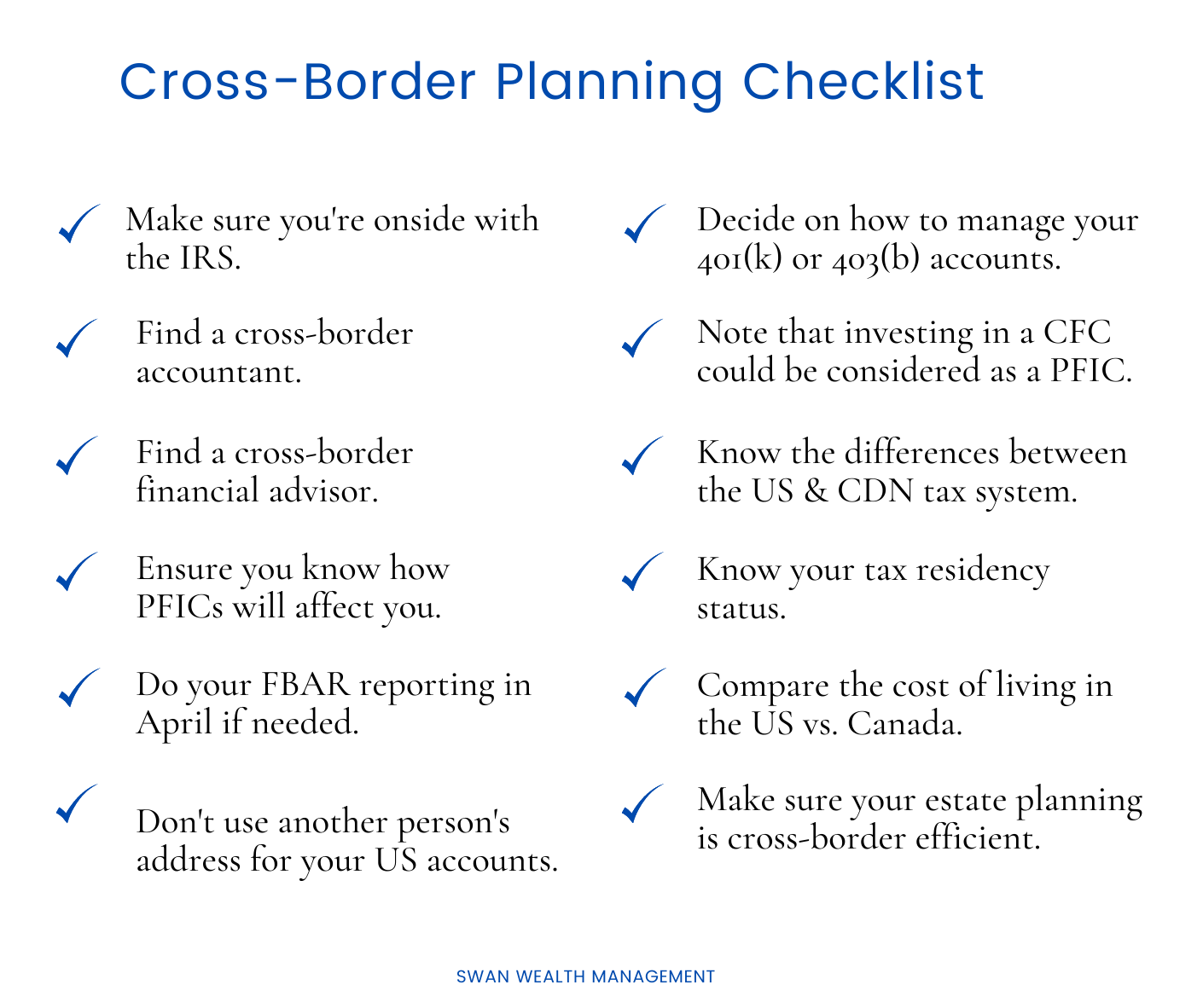

Why Working with a Cross-Border Financial Advisor and Accountant Is Essential If You’re a Dual Citizen

As a dual citizen or green card holder, it is essential to work with a cross-border advisor and cross-border accountant. It will save you time, money and a lot of frustrations. A cross-border advisor will help you avoid costly mistakes such as investing in PFICs and will guide you on how to bring over your retirement assets from the US to optimize your tax liability. They can advise on how to avoid the common tax, estate and financial traps that a U.S person may make when residing in Canada. Your cross-border accountant will help ensure you utilize all the foreign tax credits available and structure your tax returns to help avoid the steep penalties of the IRS.

Are you a US or Dual Citizen Planning on Retiring in Canada?

To ensure that you’re optimizing your cross-border financial plan, we recommend speaking with one of our Cross-Border Financial Advisors. Schedule a 15-minute discovery call and find out if we can help you optimize your financial and retirement plan while also ensuring you’re minimizing your tax burden.

Schedule a Call

Common Questions About RRSPs

What are the tax implications of contributing to an RRSP in Canada?

Contributing to an RRSP allows you to defer taxes on the amount contributed and on the investment growth within the account until you withdraw the funds. However, withdrawals from an RRSP are taxed as regular income at your marginal tax rate at the time of withdrawal.

In other words, you don't have to pay tax on your RRSP contributions or the investment earnings until you withdraw the money.

What is the RRSP contribution limit for this year?

The RRSP contribution limit for 2024 is the lesser of 18% of your earned income from the previous year, or $31,560, plus any unused contribution room from previous years. (+)

How can I maximize my RRSP contribution to benefit my retirement savings?

To maximize your RRSP contributions, consider contributing early in the year to benefit from tax-deferred growth and utilizing any carry-forward contribution room from previous years. You can also adjust your budget to increase regular contributions or allocate windfalls like bonuses towards your RRSP.

What are the benefits of a spousal RRSP for couples planning their retirement?

A spousal RRSP allows a higher-income spouse to contribute to an RRSP in the name of the lower-income spouse, potentially reducing the overall family tax burden by shifting taxable retirement income to the spouse in the lower tax bracket. This strategy can be particularly beneficial for income splitting during retirement. Remember that for the strategy to work, the funds deposited must be held in the spousal RRSP for at least three years to be taxed in the spouse's hands.

About the Author

Tiffany Woodfield is a dual-licensed financial advisor and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany specializes in advising clients who live both in Canada and the United States and need to simplify their cross-border financial plan, move their assets across the border, and optimize their investments so they can minimize their tax burden. Together Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe whether they live in Canada or the US.

- SWAN Wealth Management of Raymond James Ltd. Suite 1000 - 1499 St Paul Street Suite 1000 Kelowna, BC V1Y 6P1

- T 250.979.1805

- F 250.979.2749

- Map & Directions

- Map & Directions

© 2025 Raymond James Ltd. All rights reserved.

Privacy | Advisor Website Disclaimers | Manage Cookie Preferences

Raymond James Ltd. is an indirect wholly-owned subsidiary of Raymond James Financial, Inc., regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund.

Securities-related products and services are offered through Raymond James Ltd.

Insurance products and services are offered through Raymond James Financial Planning Ltd, which is not a member of the Canadian Investor Protection Fund.

Raymond James Ltd.’s trust services are offered by Solus Trust Company (“STC”). STC is an affiliate of Raymond James Ltd. and offers trust services across Canada. STC is not regulated by CIRO and is not a Member of the Canadian Investor Protection Fund.

Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Statistics and factual data and other information are from sources RJL believes to be reliable, but their accuracy cannot be guaranteed.

Use of the Raymond James Ltd. website is governed by the Web Use Agreement | Client Concerns.

Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. | RJLU Legal

Please click on the link below to stay connected via email.

*You can withdraw your consent at any time by unsubscribing to our emails.

© 2025 Raymond James Ltd. All rights reserved. Member IIROC / CIPF | Privacy Policy | Web Use Agreement