Do Dual Citizens Pay Taxes in Both Countries?

Authors: Tiffany Woodfield, TEP®, Associate Portfolio Manager, CRPC®, CIM® and John Woodfield, Portfolio Manager, CFP®, CIM®

Yes, dual citizens may be required to pay taxes in both countries.

If you're a dual citizen of the U.S. and another country, like Canada, you are taxed on your worldwide income by the U.S., no matter where you live. For example, even if you're living in Canada and earning income there, the U.S. expects you to report your global earnings. However, most countries, including Canada, have tax treaties with the U.S. to help avoid double taxation.

If you're worried about double taxation, we recommend working with a qualified accountant and a financial advisory team specializing in cross-border. The right cross-border team can help you minimize taxes.

Careful planning is essential when you're a dual citizen. This post is meant to be a quick overview of the topic and is not a substitute for seeking professional advice.

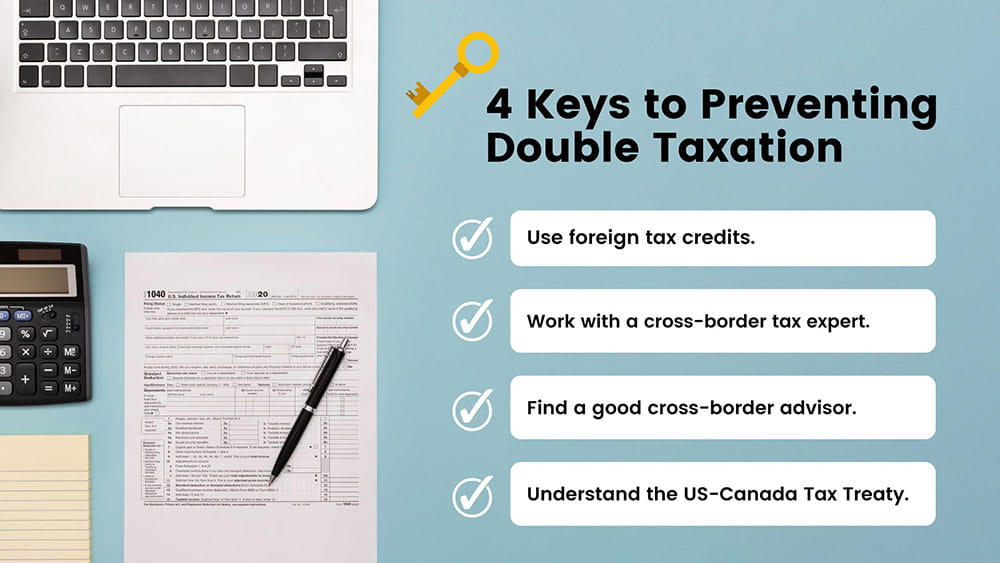

4 Keys to Preventing Double Taxation as a Dual Citizen

- Use foreign tax credits to reduce U.S. taxes.

- Understand the US-Canada tax treaty and how it affects your situation.

- Work with a cross-border tax expert to avoid pitfalls and missed opportunities.

- Seek the guidance of a cross-border financial advisor to ensure you're not invested in the wrong things based on your residency.

By staying informed and planning wisely, you can minimize the impact of double taxation.

Do Dual Citizens Pay Taxes in Both Countries?

Yes, dual citizens must report their worldwide income to both countries if they live in Canada and are considered a “US person.”

For example, if you live in Canada but hold U.S. citizenship, you must file a U.S. tax return yearly, even if your income is earned entirely in Canada. The U.S. bases taxation on citizenship rather than residency. Most countries, including Canada, base it on residency. This means as a U.S. person, you will have to report your worldwide income to the IRS, regardless of where you live.

Fortunately, the U.S. and Canada have a tax treaty to prevent double taxation.

Here’s how it works: Canadian residents pay Canadian taxes first. You then report your income to the IRS, but the U.S. allows you to claim foreign tax credits on the taxes you’ve already paid in Canada. This process helps reduce or eliminate U.S. tax liability on your Canadian income. However, planning is crucial to make sure you don’t miss any important details, such as differences in tax rules between the two countries.

If you're planning on moving abroad, find out what kind of tax treaty the US has with that country. In addition, find an accountant who understands the tax laws in both countries.

Foreign Tax Credits Are Critical

Claiming foreign tax credits is the key to avoiding double taxation.

As a U.S. citizen living in Canada, the Foreign Tax Credit (FTC) is an important tool. This credit lets you reduce your U.S. tax liability by the amount of tax you've already paid to Canada. For example, if you pay 30% tax on your income in Canada, you can often use that to offset U.S. taxes on the same income.

But keep in mind not all taxes are treated equally. You should focus on income tax, property tax, and sales tax when reviewing your options for claiming foreign tax credits. Also, don’t overlook the Foreign Earned Income Exclusion (FEIE), which can exclude part of your income from U.S. taxation.

Likewise, make sure you're aware of the tax benefits of using retirement accounts like RRSPs (Registered Retirement Savings Plans).

Most people “don’t know what they don’t know” and we recommend working with a cross-border accountant to help you take full advantage of these credits and ensure you're not paying more than necessary to either country.

Foreign Earned Income Exclusion

The Foreign Earned Income Exclusion allows U.S. citizens living abroad to exclude a portion of their foreign-earned income from U.S. taxes. For 2023, this exclusion can be up to $120,000. For the 2024 tax year, the maximum exclusion is $126,500 per person.

To qualify, you must meet specific residency requirements, such as living outside the U.S. for at least 330 days in a 12-month period. The FEIE is a valuable tool for reducing U.S. tax liability but doesn’t apply to income like capital gains or U.S.-based earnings. Proper filing is crucial to claim this benefit. Speak to your accountant because you can use both FTC and FTC but not on the same income.

You can find the up-to-date information about the FEIE on the IRS website HERE.

Tax and Investing Pitfalls to Avoid as an American Living in Canada

Work with a Qualified Accountant

Working with a qualified accountant who understands tax laws in both countries is essential.

As a dual citizen, your tax situation is far more complex than someone living and earning in just one country. A qualified cross-border accountant can help you navigate the intricate rules of the U.S. and Canada, ensuring you take full advantage of tax credits, deductions, and treaty benefits.

Without expert guidance, you could miss filing requirements or face penalties.

For example, managing foreign tax credits or correctly reporting retirement accounts like RRSPs requires detailed knowledge of tax treaties and IRS forms. Working with an accountant specializing in cross-border tax issues ensures you stay compliant, avoid double taxation, and keep more of what you earn.

Put Together Your Cross-Border Team

A solid cross-border team is critical for navigating complex financial and legal landscapes.

Having just one expert isn’t enough. To truly manage your financial life as a dual citizen, you need a cross-border financial advisor, attorney, and accountant working together. Each plays a vital role. A cross-border financial advisor ensures your investments, retirement accounts, and overall wealth strategy align with tax laws in both countries.

A cross-border lawyer helps with estate planning, residency issues, and legal compliance. And a cross-border accountant handles tax filings and ensures you’re not paying more than necessary in either country.

Together, these professionals form a team that can anticipate and manage the unique challenges of cross-border living, from minimizing taxes to protecting your estate. Without the right team, you risk costly mistakes and missed opportunities.

CLICK HERE: To Schedule a 15-minute Call with SWAN Wealth

Big Tax Mistakes to Avoid as a Dual Citizen Living Abroad

- Failing to file U.S. taxes: Even if you owe nothing, U.S. citizens must file an annual tax return, regardless of where they live.

- Ignoring FBAR (Foreign Bank Account Reporting): You must report foreign bank accounts if the total arregate value of your foreign accounts exceeds $10,000 at any time during the year.

- Overlooking foreign tax credits: Not claiming foreign tax credits can lead to paying unnecessary taxes to both countries.

- Not understanding retirement account rules: U.S. and Canadian retirement accounts, such as IRAs and RRSPs, have different tax treatments that require careful management.

- Assuming tax treaties cover everything: Tax treaties help, but they don’t eliminate all tax obligations or penalties.

Common Questions

How do dual citizens handle capital gains taxes on the sale of property abroad?When selling property abroad, dual citizens may face capital gains taxes in both the U.S. and the foreign country. Tax treaties can sometimes prevent double taxation, and foreign tax credits and PRE exemptions may also help offset U.S. taxes on the sale. Reporting is crucial to avoid penalties.

As an American living in Canada, will I owe taxes in the U.S. if I sell a house in Canada?Yes, the U.S. taxes capital gains on the sale of foreign property. However, you can use foreign tax credits to offset U.S. taxes for any Canadian taxes paid on the sale. Reporting the sale to the IRS is still required.

How does the IRS treat income earned from a business operated in Canada by a dual citizen?Income earned from a business in Canada is subject to U.S. taxes, even if it’s fully taxed in Canada. Foreign tax credits or tax treaties may help offset the tax. U.S. reporting requirements for foreign businesses, including filing Form 5471, must be followed. Speak with your accountant about this matter; they will have strategies to help guide you.

What are the tax benefits of using RRSPs if you're a U.S. citizen living in Canada?Usually, the tax rates are higher in Canada than in the U.S., which means if you are eligible to put money into your RRSP, this is beneficial as it reduces your current Canadian tax liability. For U.S. citizens in Canada, the US-Canada Tax Treaty recognizes RRSPs. This means you can defer U.S. taxes on the income in your RRSP until withdrawal. Remember, proper IRS reporting is necessary to take advantage of this benefit, including filing Form 8891 or using other applicable treaty provisions. By deferring taxes in both countries, you maximize growth while minimizing your tax burden in the present.

What do I need to know about FBAR rules?U.S. citizens must file an FBAR if they have foreign bank accounts and the aggregate value exceeds $10,000 at any point during the year. This form helps the IRS track offshore accounts and ensure compliance. Failing to file can result in heavy penalties, even if no taxes are owed.

What forms do I need to file taxes in the US if I'm a dual citizen?Dual citizens must file Form 1040 to report worldwide income, along with FBAR (FinCEN Form 114) for foreign bank accounts. You may also need to file Form 8938 for foreign assets and Form 1116 to claim foreign tax credits.

Will expatriating remove my U.S. tax liability?Expatriating may end your U.S. tax liability, but only after you formally renounce your citizenship and settle any outstanding taxes. Some high-net-worth individuals may face an "exit tax" if their assets or income exceed certain thresholds.

From a tax perspective, what is the biggest downside of dual citizenship?The biggest downside is the complexity of managing tax obligations in two countries. Dual citizens must file U.S. tax reports annually, even while living abroad, and may face double taxation or penalties if they fail to manage foreign accounts or assets properly. But, it becomes simplified if you have everything set up correctly and a team that understands what is necessary.

How can I stay compliant with both countries’ tax laws without overpaying?To stay compliant, you must understand the tax filing requirements in both countries. Working with cross-border tax professionals is key. They help you navigate treaties, claim tax credits, and handle reporting requirements like FBAR, ensuring you don’t overpay or face penalties.

Next Steps

If you’re a Canadian resident or are planning on moving to Canada or the U.S. and need assistance with moving and optimizing your investments, estate planning, wealth management and portfolio management, please get in touch. At SWAN Wealth, we specialize in Canadian financial planning, cross-border financial planning and cross-border wealth management.

Read More

If you’re planning a cross-border move, these articles and guides will help you simplify your move and ensure everything is covered.

A Simple Guide to U.S. Taxes in Canada

Cross-Border Estate Planning Guide

Foreign Tax Credits in Canada and the U.S.

About the Authors

Tiffany Woodfield is an Associate Portfolio Manager licensed in Canada and the U.S., a Chartered Investment Manager (CIM), a Chartered Retirement Planning Counselor (CRPC), a Trust and Estate Practitioner (TEP) and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany advises clients who live in Canada and the United States and want to simplify their cross-border financial plan, move their assets across the border, and optimize their investments to minimize their tax burden. Together, Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe whether they live in Canada or the U.S.

John Woodfield is a Financial Management Advisor (FMA), a Chartered Investment Manager (CIM), and a Certified Financial Planner (CFP), and in 2007 was inducted as a fellow of the Canadian Securities Institute (FCSI). As a portfolio manager and CFP®, he works with clients across Canada. John Woodfield’s clients are families, individuals and business owners who understand the importance of comprehensive wealth and investment plans driven by the lifestyle they want to lead.

Schedule a Call

Schedule a 15-minute introductory call with SWAN Wealth Management. Click here to schedule a call.