Financial and Tax Planning for US citizens living in Canada

Written by Tiffany Woodfield, CRPC®, CIM®, TEP®

US Citizens Living in Canada: Financial and Tax Planning Essentials

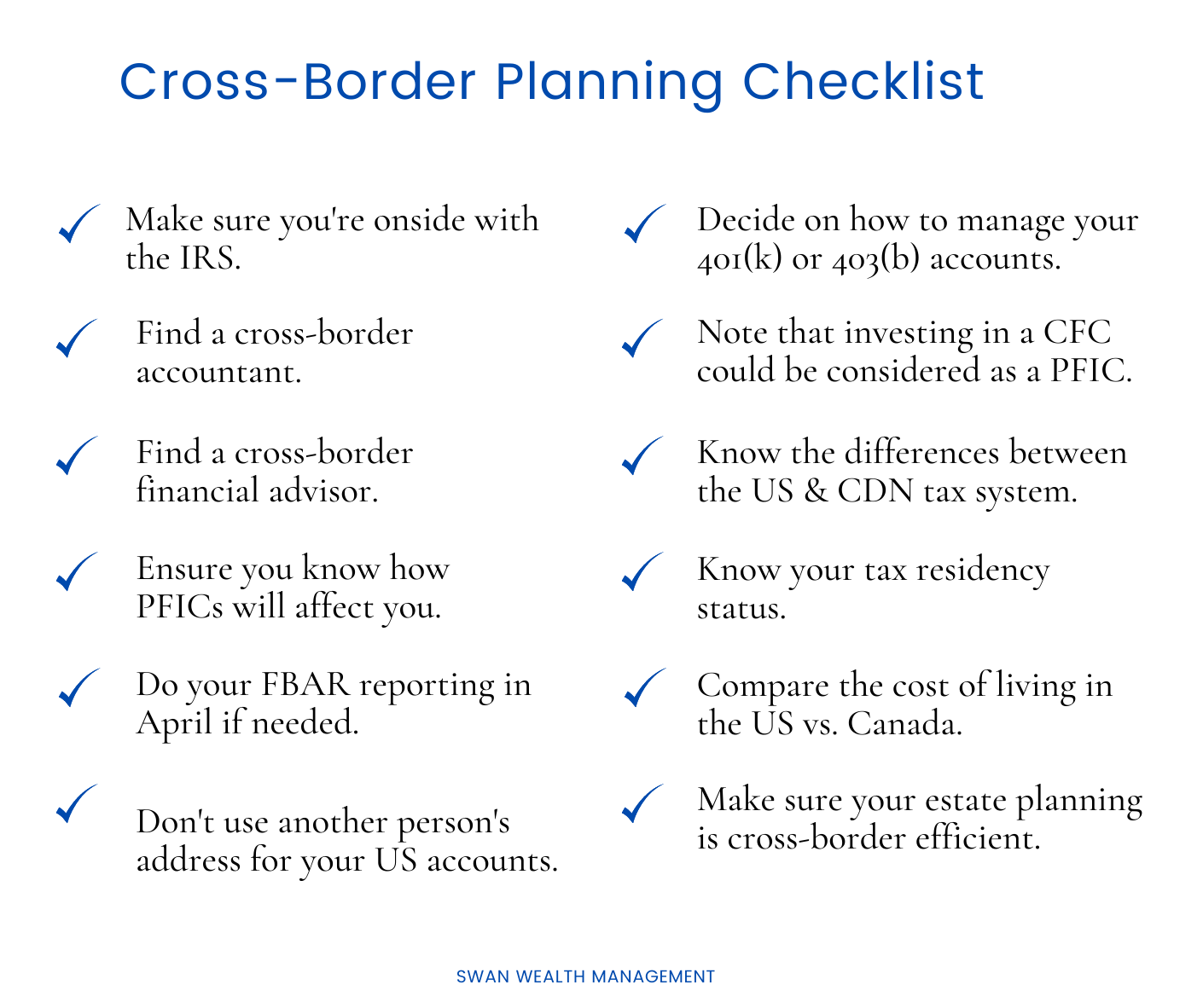

Many U.S. citizens or dual citizens who are living in Canada don’t fully understand the tax and financial consequences of being tax residents of Canada while also maintaining US citizenship. Tax planning and correct investment planning are critical.

A U.S. citizen or green card holder living in Canada has to report their worldwide income to the Canada Revenue Agency (CRA) and to the U.S. Internal Revenue Service (IRS). If done properly, a taxpayer most often does not owe any taxes to the IRS thanks to the Canada-US Tax Treaty. This treaty allows a foreign taxpayer to use foreign tax credits against U.S. tax for the amount paid in Canada.

U.S. regulations are now being enforced much more strictly.

This has prompted many of the brokerage firms to send letters stating they can no longer service non-resident accounts. The closure of an account leaves the retirement account holder with the choice between moving to a cross-border advisor or taking a sizable tax hit. Cross-border licensed advisors can manage these assets for those that live in either Canada or the United States.

Table of Contents:

- Tax Considerations and Consequences

- Summary of Key Points

- Tax Traps Every US Citizen Living in Canada Should Know

- How is the US Tax System Different from the Canadian Tax System

- Is Double Taxation Something to Worry About?

- Are You a Resident of Canada for Tax Purposes?

- US-Canada Tax Treaty Basics

- Tax Rates in Canada for 2024

- Canadian Pension Plan vs. Social Security

- Can You Collect OAS If You Live in Canada?

- Can You Collect CPP If You’re American?

- Canadian Taxation of Foreign Income

- FBAR Reporting

- FATCA Foreign Account Tax Compliance Act

- Transferring a 401(k) or IRA to Canada

- Estate Planning Essentials: PFICs, CFCs, and US Estate Tax

- Renouncing Your US Citizenship?

- Could You Lose Access to Your American Investment Accounts?

- Optimizing Your Retirement Investments at Any Age

- Working with a Cross-Border Advisor and Accountant

Tax Considerations for US Citizens Living in Canada

Investors often find that they owe additional tax due to inadvertently investing in Passive Foreign Investment Companies (PFIC’s). These require additional complicated tax reporting and are taxed punitively. Retirement account holders also often find that their 401(k) is frozen with no management of the assets. This not only makes monitoring the holdings difficult but adds risk since there is no oversight to adjust for market changes or changes in the investors’ personal situation.

No matter what your tax or financial situation is, there are solutions that will help you minimize your tax burden and optimize your retirement plan and investments.

When working with a cross-border accountant who understands both the Canada and U.S. tax systems, they can ensure you maximize your foreign tax credits and don’t have a “surprise” tax liability. Working with a dual Canada/US licensed financial advisor helps you to avoid costly mistakes as well. Doing so allows you to keep your retirement accounts in their tax deferred status. These advisors understand which accounts are considered PFICs and can manage your investments for your individual needs whether you live in Canada or the United States.

Summary of Key Points:

- Regulations and the surveillance of U.S citizens and green card holders living outside of the United States has increased over the past few years. The consequences of not being onside are substantial.

- Working with a cross-border accountant will help you avoid costly mistakes and ensure you take advantage of all the foreign tax credits and deductions.

- Understand how you would be affected by PFICs, CFCs and U.S. estate taxes.

- Know the tax traps as a U.S. person living in Canada.

- Strive to work with a portfolio manager who is licensed in Canada and the United States.

- Understand when you can collect CPP and Social Security, and how to maximize your benefits in both countries.

Most of us recognize that effective tax planning is important to avoid the wrath of the IRS. Managing your Canadian and U.S. investments is equally important. If you don’t work with a dual licensed Canada/U.S. advisor, you will not only experience frustration when trying to plan income streams from Canada and the U.S., but you may also face punitive damages from being invested in asset classes that are considered PFICs.

Tax Traps Every US Citizen Living in Canada Should Know

U.S. persons investing in Canada should watch out for common tax traps. If you do not work with a team that is well versed in these pitfalls, you may find you are offside too late and subject to additional taxes and penalties. This can be both costly and time consuming.

Here are some common things to avoid:

- Do not invest in TFSAs; these are an excellent way for Canadians to save money as the CRA doesn’t tax the growth or income in these accounts. Unfortunately, the IRS doesn’t treat TFSA accounts the same as the CRA. They are considered Passive Foreign Investment Companies ( PFICs) which creates an additional tax filing liability and you do not benefit from tax free growth or income.

- Retirement Education Savings Plans (RESPs) are also seen by the IRS as PFICs. Which creates an additional filing requirement as they aren’t considered tax deferred plans by the IRS, and the grants are taxable to the U.S. parent. This could create a double taxation issue where the American parent is taxed on the growth and grants in the account, and the child is taxed by the CRA when they take the money out.

- Canadian Mutual Funds and Canadian ETFs are also seen as PFICs by the IRS. These create punitive tax consequences and an additional tax filing liability. It is better to invest in individual investments through a portfolio manager than a packaged product. You can still utilize U.S. ETFs and mutual funds without PFIC issues.

- Investing in a Canadian Holding Company that produces passive income causes costly and complicated tax filings. It could be considered a PFIC or Canadian Foreign Corporation (CFC). A CFC is a foreign corporation with U.S. shareholders who have either more than 50% of the voting power or 50% of the earnings. (Note: A U.S shareholder is a US person who owns 10% or more of the voting power). The US global intangible low-taxed income (GILTI) may apply. This tax applies if profits from the CFC exceed 10% on the CFC’s depreciable tangible assets.

For example: Dr DeWalt moves to Canada from the US and is a dual Canadian/US citizen. If he operates his medical practice through a Canadian corporation and earns an income more than 10% of the tangible business assets, he will be subject to the GILTI tax. If you run the numbers and he owns $30,000 of medical equipment, pays himself an annual salary of $150,000 and earns $450,000, Dr DeWalt would have $297,000* of his income reportable on his US tax return and could be taxed up to 37%.

*$450,000-150,000-10%(30,000)= $297,000

- Rolling over an IRA to an RRSP, while possible, causes complications. When rolling over to an RRSP, there are withholding taxes in the U.S., so you will have to top up the RRSP from other sources, or you will be taxed on the 15% withheld as income inclusion in Canada.

How is the US Tax System Different from the Canadian Tax System?

Single Filer or Married Filing Jointly

United States citizens can file as a single filer or as married filers, filing jointly. Whereas, in Canada you only have the option to file your income taxes as an individual.

Tax based on Citizenship or Residency

The U.S. taxes worldwide income based on citizenship regardless of where the taxpayer lives. In Canada, you are taxed based on residency. So if you live in Canada, you have to file a tax return to the Canada Revenue Agency (CRA) in Canada.

Estate/Death Tax

In the United States, there is a one-time tax occurring at death called the Estate Tax. In 2020, if your estate is worth more than USD $11.5 million, you will pay tax on the amount above this exemption amount. The exemption limit is set to return to USD $5 million in 2026.

Home/Principle Residence

An individual’s principal residence in the U.S. has an exclusion on capital gains of USD $250,000 if single, or USD $500,000 if married and filing jointly. There are a couple of rules you must follow to receive this exclusion. You need to have lived in the home 2 of the past 5 years immediately preceding the sale of the home, and you can’t have used this exclusion on another home in the last 2 years. You will pay tax at the long-term capital gains rate on any capital gains above these amounts. In Canada, there is a principal residence exemption and the capital gain on your principal residence, regardless of amount, is tax free.

Income Tax Rates

Canada and the United States both have federal taxes. However, in the U.S. some states have no state income taxes; whereas, all Canadian provinces have provincial tax. The federal tax rates in the U.S. range from 10% to 37% and in Canada range from 15% to 33% of taxable income. (See further in article for details on provincial rates in Canada.)

Capital Gains

In Canada, 50% of your capital gain is taxed at your marginal income tax rate regardless of how long an asset is owned. For example, if an investor has a capital gain of $100,000 then only 50% or $50,000 would be added to taxable income and taxed at their current marginal rate. In the U.S., capital gains are based on the length of time an asset is held. Investors pay long-term rates if the asset was held over one year, or short term rates if held for less than a year. The short term capital gains are taxed as ordinary income at an investor’s current tax rate. Long-term capital gains are taxed more favorably. The rate ranges from either 0%, 15%, to at most 20%.

Social Security and CPP Rates

American employees and employers each pay 7.65% - a total of 15.3% - of their taxable income into Social Security and Medicare.

In Canada, employees and employers each pay 5.95% for a total of 11.4% of their taxable income into CPP and medical benefits are included. The income taxes Canadians pay fund socialized health care. U.S. healthcare is primarily paid for out of pocket. Because U.S. resident employees pay a higher percentage of their income into social security, they receive higher monthly benefits in retirement than a person who earned the same income and paid into CPP in Canada.

Step-Up Basis versus Cost Basis

In the U.S., when a person dies, the individual inheriting an asset uses the current fair market value as their cost basis. This means the gain from when the initial person owned the asset to when they pass away isn’t taxed. If it is passed from one spouse to another, there may even be a second step up and the new cost basis is when the second spouse dies. Children or other beneficiaries benefit from significant tax savings.

In Canada, when an individual dies, the estate has to pay the taxes before transferring the proceeds to the beneficiaries, unless there is a surviving spouse. Assets are assumed to have been sold the day before the death at fair market value.

Is Double Taxation Something to Worry About?

The United States-Canada Income Tax Treaty helps to prevent double taxation by exempting U.S. citizens from being taxed in the U.S. on income earned and taxed in Canada. Those not working with a cross-border team familiar with the intricacies of the two systems may face double taxation. Another pitfall is when U.S. persons inadvertently invest in products or structures that fall outside of the treaty. A common example of this is holding an RESP. In this case, the U.S. subscriber and beneficiary may end up paying double tax and may be subject to penalties when unwinding the plan.

Are You a Resident of Canada for Tax Purposes?

You are a resident of Canada for tax purposes if you spend more than 183 days in a calendar year in Canada and if your primary residence is considered to be in Canada. Significant residential ties to Canada are a home in Canada, dependents in Canada, or a spouse/common-law partner in Canada. You can be a daily commuter crossing the border to work in Canada and still be considered a U.S. resident while living in Canada if you don’t have the above significant residential ties to Canada.

As a U.S person living in Canada, you are taxed on money earned in Canada. This can be from investment interest or capital gains, employment income, or if you take money out of your IRA or 401(k).

US-Canada Tax Treaty Basics

The U.S.-Canada Tax Treaty was created to ensure that an individual isn’t taxed on the same income in both countries in the same year. This is done through foreign tax credits. Those considered a resident of Canada pay tax on their worldwide income. A U.S. person living in Canada also has to file a U.S tax return including all their income earned from employment, interest and capital gains on investments.

A resident of Canada will have paid tax in Canada and therefore will not be taxed again on this income on their U.S. taxes. Usually the combined Canadian federal and provincial personal income tax rates are higher than the combined U.S. Federal and State personal income tax rates. In most cases, aside from filing with the IRS, taxpayers will not owe additional money.

Tax Rates in Canada for 2024

In Canada, federal and provincial rates in all provinces are based on a marginal tax rate. This means lower tax on the first dollar earned, and a higher rate on the last dollar earned (assuming the last dollar earned is in a higher tax bracket). As a result, lower income earners pay less tax, as a percentage, than higher income earners.

Federal Tax Rates in Canada

You pay 15% on the first $55,867 of taxable income

You pay 20.5% on taxable income over $55,867 up to $111,733

You pay 26% on taxable income over $111,733 up to $173,205

You pay 29.32% on taxable income over $173,205 up to $246,752 and

You pay 33% of taxable income over $246,752

Many people get confused and think that if they have earned more than $246,752, they are paying 33% tax on all their income. However, because of marginal tax rates, they only pay 33% tax on the income earned over this threshold. They still pay 15% on the first taxable dollar earned up to $55,867.

Please note that these numbers are just the Federal income tax rates; you also pay provincial tax rates in Canada.

Provincial Tax Rates for BC and Ontario

Each province has a provincial tax rate and a federal tax rate.

Taxpayers pay a combination of provincial and federal taxes. For example, if you live in Ontario, the tax rate for income over $246,752 would be 33% federal and 13.16% provincial, for a total of 46.16%. In BC, for the same income, your tax rate would be 53.5%.

Many of our clients who have moved from the U.S. are surprised by Canada’s high tax rates and the fact that you don’t have the option to file jointly with your spouse to reduce your overall taxes. This is where working with an accountant and having tax planning strategies to get your income to a lower marginal rate can have a significant impact.

In BC, provincial tax rates are:

- 5.06% on the first $47,937 of taxable income or less plus

- 7.7% on the portion of taxable income over $47,937 up to $95,875 plus

- 10.5% on the portion of taxable income over $95,875 upt to $110,076 plus

- 12.29% on the portion of taxable income over $110,076 up to $133,664 plus

- 14.7% on the portion of taxable income over $133,664 up to $181,232 plus

- 16.8% on the portion of taxable income over $181,232 up to $252,752 plus

- 20.5% on amounts over $252,752

In Ontario, provincial tax rates are:

- 5.05% on the portion of taxable income over $51,446 or less, plus

- 9.15% on the portion of taxable income over $51,446 up to $102,894 plus

- 11.16% on the portion of taxable income over $102,894 up to $150,000 plus

- 12.16% on the portion of taxable income over $150,000 up to $220,000 plus

- 13.16 % on the portion of taxable income over $220,000

Canadian Pension Plan vs Social Security

In the United States and Canada, there are mandatory old-age pension systems that are publicly funded through taxes.

Both pensions offer benefits for retirement, disability, survivors, and minor children. The benefits from CPP tend to be lower than those from Social Security because the FICA rate each employee and employer contributes is higher than the rate for CPP in Canada.

The average CPP monthly payout in 2024 is CAD $816.52, and the maximum payout is CAD $1346.60. The average social security payment in 2024 is USD $1,862 per month, and the maximum monthly benefit is USD $3,822. Both of these depend on your earnings history and whether you file early, at full retirement age, or at age 70.

Can You Collect OAS if You Live in Canada?

Old Age Security (OAS) is Canada’s largest pension program and it is funded from general tax revenues. To be entitled to collect Old Age Security in Canada (OAS), you need to be 65 years or older, a Canadian citizen or permanent resident of Canada, and have lived in Canada after the age of 18 for at least 10 years.

Can You Collect CPP If You’re American?

U.S. citizens may be eligible for the Canada Pension Plan (CPP) if they worked in Canada after the age of 18 and paid into CPP through payroll deductions. They also may receive credits from a former spouse or former common law relationship. Working in the U.S. may qualify towards CPP due to the Canada-US Totalization Agreement between the two countries.

To get your CPP information register for a My Service Canada Account here.

Canada-U.S Totalization Agreement

Canadian Taxation of Foreign Income

Canadian residents are taxed on income earned worldwide regardless of where it is earned. You also will pay taxes in the country where you earned the income whether it be from running a business or income from an investment property. To avoid having to pay tax on the same income in both countries, you can claim a foreign tax credit or a deduction to Canada Revenue Agency (CRA).

In addition, if you are a Canadian resident and own U.S. stocks in a non-registered account, there will be a 15% withholding tax on any dividends earned and a 10% withholding tax on interest earned.

You need to file a W-8 Ben form if you are a Canadian resident who receives payment from U.S. companies; otherwise the default withholding tax rate is 30%. If you are a U.S. person, you will be asked to sign a W-9 (Request for Taxpayer Identification Number and Certification) form instead of a W-8 from your Canadian brokerage firm or bank. This form was created by the IRS and allows the financial institution to issue a Form 1099 when you receive any payments from the account.

FBAR Reporting

Foreign Bank Account Reporting (FBAR) reporting started in 1970 as a way to prevent and discourage tax evasion. As a result, all US citizens must report all foreign financial assets to the Treasury department every year if their funds . Many clients think if they don’t have $10,000 in a particular account they don’t have to report but if all their accounts added together are over $10,000, even if by only $100, they need to report all accounts. For those that forget to file an FBAR there is a penalty of $10,000 for each non-willful violation. If it is found to be willful, the penalty goes up to $100,000 or 50% of the amount in the account.

FATCA Foreign Account Tax Compliance Act

This act came into effect in 2014 and was designed to reduce tax evasion concerning offshore financial assets. As a result, foreign financial institutions must report information related to accounts held by U.S. taxpayers if the value is more than the $50,000 reporting threshold. If there is non-compliance, the IRS will red flag for potential issues and there could be serious penalties.

Transferring a 401k/IRA to Canada

To transfer a 401(k) to Canada, an option is to move the 401(k) to a rollover IRA and then have it managed by a dual Canada/U.S licensed advisor. An IRA is an excellent retirement plan as it allows multiple beneficiaries to keep the tax deferred status, and therefore stretches out the tax liability. While it is possible to move a 401(k) into a rollover IRA and then to a RRSP/RRIF, this often isn’t the best solution.

Although a Canadian RRSP is similar to an IRA, there are complications when transferring an IRA to a RRSP. When moving an IRA to an RRSP/RRIF there are withholding taxes from the U.S.

In order to recoup this tax, you have to find funds from other sources to top up the RRSP. If you do not have the funds, or choose not to top up the plan, this room is lost forever and you are taxed on the amount you did not add to the plan.

Estate Planning: PFICS, CFCs, and US Estate Taxes

PFICs

In the U.S. any non-U.S. corporation that has at least 75% of its income considered passive income is seen as a Passive Foreign Investment Company (PFIC).

PFICs include commonly used investments in Canada such as Canadian mutual funds and Canadian ETFs.

As PFICs, they require additional complex reporting. Moreover, the Foreign Account Tax Compliance Act (FATCA) has increased the IRS's ability to enforce the PFIC rules.

CFCs

A controlled foreign corporation (CFC) is a non-U.S. corporation with more than 50% of the stock owned by U.S. shareholders. Canadian private corporations and holding companies may fall under these rules and require special reporting. The IRS has rules to prevent tax deferral on income inside a CFC to gain a tax advantage.

US Federal Estate Taxes

U.S. Federal Estate Taxes apply to estates where the current value of assets is worth more than USD $13.61 million as of 2024. This means that you can transfer up to this amount without having a tax hit. Any amount above this exclusion amount may be subject to a 40% tax.

There are tax planning opportunities with a spouse. In addition, you also have an annual amount of $18,000 (per person for 2024) that you can give without impacting your lifetime credit. You may want to give a gift sooner rather than later as the level at which estate taxes may apply is scheduled to be reduced to USD $5 million, adjusted to inflation after 2025.

Renouncing Your US Citizenship - Necessary or Not?

Some people fear the liability of having a continual tie to the U.S. and the potential tax burden from the IRS, and think the solution is to renounce citizenship. This may be the best decision for some, but before you decide to start this costly and time consuming process, speak to a cross-border tax accountant to understand your tax liability. The continual tax filing obligation often doesn’t mean you owe taxes in the U.S. because, in Canada, we have a higher tax liability and foreign tax credits reduce any tax owed to the United States.

Keeping your U.S. citizenship allows you the benefit to move back to the United States if you decide to in the future. It is a personal decision and all factors should be taken into consideration, not just the potential tax liability. Concerning your investments, when you work with a Cross-Border Financial Advisor, they can help you whether you live in Canada or the U.S. so this doesn’t need to be a consideration.

Could You Lose Access to Your American Investment Accounts?

When clients move across the 49th parallel, they often don’t worry about how to move their investments. The U.S regulations are being enforced more strictly, and this is causing brokerage firms to send letters to non-residents of the U.S stating they can no longer manage their accounts. This means a client has to find another advisor or they will be forced to close out the account in 60-90 days.

Using a friend or relative’s address in the U.S when you move to Canada creates problems. This is against Security Exchange Guidelines (SEC) and could trigger state tax when you take out the required minimum distributions (RMD’s).

If funds are held with a previous employer in a 401(k) or 403(b), once you move to Canada, your accounts are essentially frozen and access is limited. This makes it difficult to protect yourself from market problems and to be able to create an income stream. It also adds unwanted risk because you may be overexposed in some investments and underexposed to other asset classes.

Optimizing Your Retirement Investments at Any Age

When making the decision on where to hold your retirement investments, you should strive to find an advisor who is a portfolio manager and works with a team. A portfolio manager is able to hold individual investments and tailors these for each client’s situation. Also, they have a fiduciary duty to put a client’s needs first.

Many financial advisors are limited to packaged products, such as mutual funds, and act as middlemen between the clients and the mutual fund company rather than as a fiduciary. This often increases the costs to the client and reduces customization. If you’re investing with a portfolio manager, it means you own the underlying investments directly. Lastly, the costs for a portfolio manager may be tax deductible while mutual fund fees are not.

Working with a Cross-Border Financial Advisor and Accountant Is Essential

Each year, the IRS seems to increase its surveillance of U.S. persons living abroad. Since the Foreign Account Tax Compliance Act (FATCA) came into legislation, the IRS has been increasing their enforcement of rules around foreign investments and bank accounts. Consult with a cross-border financial advisor and a cross border accountant to prevent costly mistakes.

Your US advisor is no longer licensed to help you once you move to Canada. A cross-border financial advisor can help to simplify your situation and a cross-border accountant can help you plan ahead so you can mitigate a large taxable event.

Are you a US Citizen Living or Working in Canada?

To ensure that you’re optimizing your cross-border financial plan, we recommend speaking with one of our Cross-Border Financial Advisors. Schedule a 15-minute discovery call and find out if we can help you optimize your financial and retirement plan while also ensuring you’re minimizing your tax burden.

Common Questions about Taxes for U.S. Citizens Living in Canada

What basics do U.S. citizens living in Canada need to know about taxes?

U.S. citizens living in Canada must file tax returns in both the U.S. and Canada, reporting their worldwide income to both tax authorities. They should work with a cross-border accountant who understands the tax treaty between the two countries to avoid double taxation.

How should I report my foreign financial accounts to the IRS?

U.S. citizens must file an FBAR (FinCEN Form 114) if the aggregate value of their foreign financial accounts exceeds $10,000 at any point during the year. They may also need to file Form 8938 if their specified foreign financial assets exceed certain thresholds.

What are the main differences between Canadian taxes and U.S. taxes?

Canadian taxes are generally higher than U.S. taxes and are based on residency, while U.S. taxes are based on citizenship. If you are a Canadian who moves to the U.S. and doesn't own any property or assets in Canada, you likely won’t have an ongoing filing obligation to Canada. If you are considered a “U.S. person,” you will always need to report your global income to the IRS regardless of where you live.

Do I need to file a Canadian tax return as a U.S. citizen living in Canada?

Yes, if you are a resident of Canada, you must file a Canadian tax return and report your worldwide income. This is in addition to your U.S. tax return.

What are my tax obligations as a U.S. citizen living in Canada?

You must file annual tax returns with the IRS and the Canada Revenue Agency, reporting your worldwide income to each. Additionally, you may have to report foreign financial accounts and assets to the IRS and a T1135 to Canada if you have foreign property above a certain value.

Can I claim the foreign earned income exclusion to reduce my U.S. tax liability?

Yes, you can claim the Foreign Earned Income Exclusion (FEIE) by filing Form 2555, which allows you to exclude up to a certain amount of foreign-earned income from U.S. taxation. The other option is to utilize foreign tax credits to claim a dollar-for-dollar credit for the income tax paid in Canada. Your cross-border accountant can help you determine which results in the lowest taxes payable.

How do I report specified foreign financial assets to the IRS?

You report specified foreign financial assets by filing Form 8938 with your annual tax return if your foreign assets exceed the IRS reporting thresholds. This form is separate from the FBAR, and both may be required.

How is Canadian income tax calculated for U.S. citizens living in Canada?

Canadian income tax is calculated based on progressive tax rates applied to your taxable income, including income earned worldwide. As a U.S. citizen, you will still be subject to U.S. tax laws and may need to utilize tax credits and treaties to avoid double taxation.

Schedule a Call

About the Author

Tiffany Woodfield is a dual-licensed financial advisor and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany specializes in advising clients who live both in Canada and the United States and need to simplify their cross-border financial plan, move their assets across the border, and optimize their investments so they can minimize their tax burden. Together Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams that will keep their assets safe whether they live in Canada or the US.

- SWAN Wealth Management of Raymond James Ltd. Suite 1000 - 1499 St Paul Street Suite 1000 Kelowna, BC V1Y 6P1

- T 250.979.1805

- F 250.979.2749

- Map & Directions

- Map & Directions

© 2025 Raymond James Ltd. All rights reserved.

Privacy | Advisor Website Disclaimers | Manage Cookie Preferences

Raymond James Ltd. is an indirect wholly-owned subsidiary of Raymond James Financial, Inc., regulated by the Canadian Investment Regulatory Organization (CIRO) and is a member of the Canadian Investor Protection Fund.

Securities-related products and services are offered through Raymond James Ltd.

Insurance products and services are offered through Raymond James Financial Planning Ltd, which is not a member of the Canadian Investor Protection Fund.

Raymond James Ltd.’s trust services are offered by Solus Trust Company (“STC”). STC is an affiliate of Raymond James Ltd. and offers trust services across Canada. STC is not regulated by CIRO and is not a Member of the Canadian Investor Protection Fund.

Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Statistics and factual data and other information are from sources RJL believes to be reliable, but their accuracy cannot be guaranteed.

Use of the Raymond James Ltd. website is governed by the Web Use Agreement | Client Concerns.

Raymond James (USA) Ltd., member FINRA/SIPC. Raymond James (USA) Ltd. (RJLU) advisors may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. | RJLU Legal

Please click on the link below to stay connected via email.

*You can withdraw your consent at any time by unsubscribing to our emails.

© 2025 Raymond James Ltd. All rights reserved. Member IIROC / CIPF | Privacy Policy | Web Use Agreement