What is the Difference Between RSP and RRSP?

Authors: Tiffany Woodfield, TEP®, Associate Portfolio Manager, CRPC®, CIM® and John Woodfield, Portfolio Manager, CFP®, CIM®

The terms RSP and RRSP are often used interchangeably, but they aren’t the same thing.

An RRSP is a specific type of Registered Savings Plan (RSP) in Canada. Think of an RSP as a broad category, like “fruit,” and the RRSP as a specific type of fruit, like “apple.”

All RRSPs are RSPs. But not all RSPs are RRSPs.

For example, RESPs (Registered Education Savings Plans) and TFSAs (Tax-Free Savings Accounts) also fall under the RSP umbrella.

What Are All the Different Types of RSPs in Canada?

Here are the different types of Registered Savings Plans (RSPs) in Canada:

- RRSP (Registered Retirement Savings Plan) – A tax-deferred plan for retirement savings.

- RESP (Registered Education Savings Plan) – For education savings with tax-sheltered growth.

- RDSP (Registered Disability Savings Plan) – Helps Canadians with disabilities save for long-term financial security.

- TFSA (Tax-Free Savings Account) – Allows tax-free growth and withdrawals, though contributions are not tax-deductible.

- FHSA (First Home Savings Account) – Aimed at helping first-time homebuyers with tax-deductible contributions and tax-free withdrawals.

- LRSP (Locked-In Retirement Savings Plan) – This is similar to an RRSP, but funds are locked until retirement and often come from a pension transfer.

- PRPP (Pooled Registered Pension Plan) – A retirement savings plan managed by a financial institution designed for people without workplace pension plans.

- SIPP (Specified Pension Plan) – A more customized pension plan for high-income earners, usually managed by the individual or their employer.

What Are the Tax Benefits of RSPs?

RSPs offer significant tax benefits and are designed to help Canadians grow their savings more effectively.

While some RSPs offer tax-deferred growth, others offer tax-free growth. Each RSP has different rules, contribution limits, and tax advantages. Make sure you know the tax implications of an RSP before using it as part of your wealth-building strategy.

What Are RRSPs?

RRSPs are the most popular type of RSP. They are specifically designed to help Canadians save for retirement.

When you contribute to an RRSP, you reduce your taxable income for the year, which may lead to a tax refund. The funds inside the RRSP grow tax-deferred, meaning you won’t pay taxes on the investment earnings until you withdraw them. Usually, you will start making withdrawals when you retire.

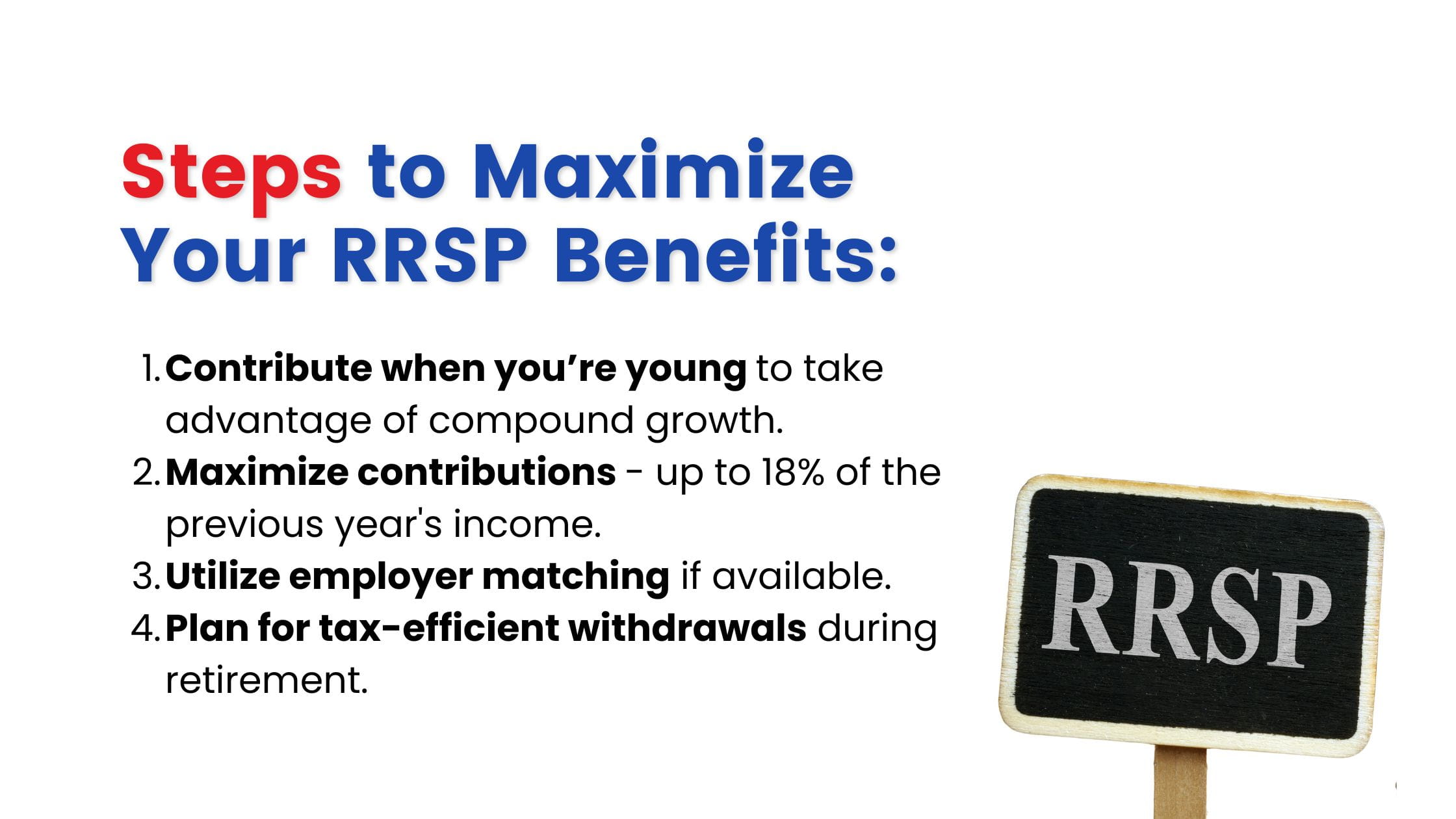

RRSPs also have a maximum contribution limit (currently 18% of your previous year’s income) up to a cap that the government adjusts annually. RRSPs are a powerful tool for long-term savings, especially when paired with employer matching programs.

How Do RRSPs Work?

What Is the Purpose of an RRSP?

The primary purpose of an RRSP is to help Canadians save for retirement.

An RRSP allows you to contribute a portion of your income and get an immediate tax break, as contributions are tax-deductible. The funds in the account grow tax-deferred, which means you won’t pay taxes on interest, dividends, or capital gains until you withdraw the money in retirement.

You will likely be in a lower tax bracket when you retire, reducing the tax you'll pay on withdrawals. This makes RRSPs a powerful tool for long-term retirement planning, especially when you start contributing early.

Which RSPs Can Green Card Holders or Americans Living in Canada Utilize?

Green Card holders and Americans living in Canada can utilize several RSPs but with careful consideration of cross-border tax rules.

The RRSP is the most commonly used RSP by Americans in Canada, offering tax-deferred growth. The IRS recognizes RRSPs under the Canada-U.S. income tax treaty, which means you won't face immediate U.S. tax on the earnings inside the account, though you do need to file Form 8891 or report it via FATCA.

The TFSA, however, isn’t ideal for Americans. The IRS does not recognize its tax-free status, meaning earnings are taxable in the U.S.

Other plans, such as the RESP (Registered Education Savings Plan) and RDSP (Registered Disability Savings Plan), face similar issues with U.S. tax treatment, as they aren’t recognized by the IRS and can trigger additional reporting.

For Green Card holders or U.S. citizens living in Canada, it’s essential to consult a cross-border advisor to navigate these complexities and ensure compliance with Canadian and U.S. tax laws.

Common Questions about RSPs and RRSPs

What is the difference between an RSP and an RRSP?

An RSP is a general category for registered savings plans, while an RRSP is a specific type of RSP designed for retirement savings. The benefit of an RRSP is that investment income grows tax-deferred, meaning you don’t pay taxes on these earnings until you withdraw them.

What does tax-deferred growth mean?

Tax-deferred growth means that earnings inside your RRSP—such as interest, dividends, or capital gains—are not taxed as they accumulate. You only pay taxes when you withdraw the money, ideally when your income—and therefore your tax rate—may be lower.

Are there contribution limits for RRSPs?

Yes, RRSPs have annual contribution limits. The limit is 18% of your previous year’s income, up to a maximum set by the government each year. For 2024, the limit is $31,560. Contributions exceeding the limit may result in penalties, so staying within your allowable amount is essential.

Can I withdraw money from my RRSP anytime?

Yes, but withdrawing from your RRSP before retirement can trigger taxes. The amount you take out is added to your taxable income for that year, and withholding taxes will apply. However, specific programs like the Home Buyers’ Plan allow withdrawals without immediate tax penalties under certain conditions.

Can non-residents contribute to an RRSP?

Non-residents can hold and contribute to an RRSP, but it might not be beneficial. Contributions will not lower non-residents' taxable income in Canada, and withdrawals may be subject to Canadian withholding tax. Cross-border tax planning is essential if you’re a non-resident with an RRSP.

Is an RSP the same as an IRA?

No, an RSP is not the same as an IRA. An RSP is a Canadian retirement or savings plan, while an IRA (Individual Retirement Account) is a U.S. “equivalent.” Both have tax advantages, but the countries' rules for contributions, withdrawals, and tax treatment differ.

Which type of RSP provides an income tax deduction?

The RRSP provides an income tax deduction. Contributions to an RRSP can reduce your taxable income for the year, which may result in a tax refund. RRSPs are a powerful tool for deferring taxes while saving for retirement.

What is a Registered Retirement Income Fund?

Registered Retirement Income Funds (RRIFs) are used to withdraw income during retirement. After converting your RRSP to an RRIF, you must start making annual withdrawals, which are taxable as income. RRIFs are designed to provide a steady income stream while keeping your retirement savings tax-sheltered until withdrawal.

Which retirement savings plans are best for high-income earners?

RRSPs are great options for high-income earners because they offer immediate tax deductions and long-term tax-deferred growth. A Specified Pension Plan (SIPP) or Pooled Registered Pension Plan (PRPP) may offer tailored benefits for those seeking more customized pension solutions.

When do you have to convert an RRSP to a RRIF?

You must convert your RRSP to an RRIF or another retirement income option by the end of the year you turn 71. This conversion is required to start regularly withdrawing from your retirement savings, as RRSPs are designed for accumulation rather than income generation in retirement.

When do you have to start taking withdrawals from a RRIF?

You must start taking withdrawals from your RRIF in the year after you convert your RRSP. The government sets a minimum withdrawal amount based on your age, and each withdrawal is considered taxable income. These withdrawals ensure you gradually access your retirement savings.

RRIFs vs. RRSPs

Next Steps

If you’re a Canadian resident or are planning on moving to Canada or the U.S. and need assistance with moving and optimizing your investments, estate planning, wealth management and portfolio management, please get in touch. At SWAN Wealth, we specialize in Canadian financial planning, cross-border financial planning and cross-border wealth management.

Read More

Canadian RRSP Facts for U.S. Citizens Living in Canada

Can You Turn an IRA into an RRSP

How to Turn Your 401(k) into a RRSP If You’re a U.S. Citizen Moving to Canada

401(k) vs RRSP - What do they have in common?

About the Authors

Tiffany Woodfield is an Associate Portfolio Manager licensed in Canada and the U.S., a Chartered Investment Manager (CIM), a Chartered Retirement Planning Counselor (CRPC), a Trust and Estate Practitioner (TEP) and the co-founder of SWAN Wealth Management, along with her husband, John Woodfield. Tiffany advises clients who live in Canada and the United States and want to simplify their cross-border financial plan, move their assets across the border, and optimize their investments to minimize their tax burden. Together, Tiffany and John Woodfield help their clients simplify their cross-border finances and create long-term revenue streams to keep their assets safe whether they live in Canada or the U.S.

John Woodfield is a Financial Management Advisor (FMA), a Chartered Investment Manager (CIM), and a Certified Financial Planner (CFP), and in 2007 was inducted as a fellow of the Canadian Securities Institute (FCSI). As a portfolio manager and CFP®, he works with clients across Canada. John Woodfield’s clients are families, individuals and business owners who understand the importance of comprehensive wealth and investment plans driven by the lifestyle they want to lead.

Schedule a Call

Schedule a 15-minute introductory call with SWAN Wealth Management. Click here to schedule a call.